B2B Large-Value Crypto Payments – Secure Enterprise Hosting and High-Concurrency Processing Solutions

Secure B2B crypto payments for enterprises: Instant, low-fee stablecoin transfers & high-concurrency hosting. Solve compliance & scale global settlement with $3B+ in case studies.

Introduction: The B2B payment landscape is undergoing profound changes driven by cryptocurrencies. In the past two years, enterprise-grade stablecoin payments have surged 30-fold, challenging traditional cross-border settlement models with their near-instantaneous and low-cost advantages. Faced with efficiency bottlenecks and compliance challenges, how can enterprises transform crypto payments from a technological tool into a core strategic asset? This article provides an in-depth analysis of market trends, security architecture, and industry practices to help you grasp the key window for upgrading global financial settlement.

A million-dollar Bitcoin payment was completed almost instantly, with extremely low fees that dwarf traditional cross-border settlement models. This is an institutional-grade transfer record completed by Secure Digital Markets (SDM) via the Bitcoin Lightning Network in February of this year.

While the industry is still discussing this milestone, data from cryptocurrency analytics firm Artemis and investment firm Dragonfly shows that B2B stablecoin payments have surged 30-fold in the past two years—from $100 million in 2023 to $3 billion in February 2025.

The global financial settlement system is undergoing profound changes brought about by blockchain technology. Enterprise-grade stablecoin payments are moving from the proof-of-concept stage to commercial-scale application. This is not only a technological iteration but also an upgrade of the global trade settlement infrastructure.

Industry Trends: B2B Crypto Payments Go Mainstream

The efficiency bottlenecks of traditional B2B cross-border payments are driving technological change. Data shows that traditional trade fund settlements typically take 3-5 business days, with fees reaching as high as 5%. In contrast, stablecoins, through the distributed ledger technology architecture of blockchain, promise to achieve instant settlement and extremely low fees.

The market expansion speed is beyond imagination. From February 2024 to February 2025, the application scale of stablecoins in the global B2B cross-border trade transaction field increased fourfold year-on-year. The U.S. Treasury Department further predicts that the stablecoin market could grow from its current $240 billion to $2 trillion by 2028. This rapid rise is reshaping the B2B cross-border trade payment ecosystem, representing not only technological upgrades but also a revolution in business models.

The application of crypto payments has transcended personal consumption, with enterprise-level use becoming the main growth engine. As of February 2025, peer-to-peer (P2P) stablecoin payments totaled approximately $1.5 billion, only half the volume of B2B transactions.

Rob Hadick, a partner at Dragonfly, points out that businesses are increasingly using stablecoins for supplier payments, fund management, and payroll.

Enterprise Pain Points: Key B2B Payment Efficiency | Compliance Challenges

For companies seeking digital transformation, B2B payments are far more than just "paying." The real bottleneck to efficiency often lies in the complex workflows scattered before and after the payment process.

From data collection and invoice management to compliance reviews, tax reconciliation, and complex multi-layered approval processes, each step can become a bottleneck in the payment process.

The pain points are particularly prominent in cross-border payments. Each jurisdiction has unique requirements for foreign currency transactions, including AML/KYC compliance checks, trade regulations, and customs procedures.

Tax processing is even more complex in cross-border transactions, ranging from import duties to value-added tax (VAT), requiring precise tax tracking and liability allocation. Furthermore, complex approval chains often exist between subsidiaries and parent companies, and any errors in local compliance, product classification, or document preparation can lead to indefinite delays in the payment process.

Enterprise stablecoin payments also face specific technical and managerial challenges. Large transactions often encounter three major pain points: liquidity constraints, excessively long settlement times, and complex system integration.

Stability, compliance, and integration barriers with existing systems often deter enterprises. Market demands for transparency and stability, along with constantly evolving regulatory frameworks, create a dilemma for many enterprises when embracing stablecoin payments.

Technical Solution: Secure, Compliant B2B Crypto Payment Architecture

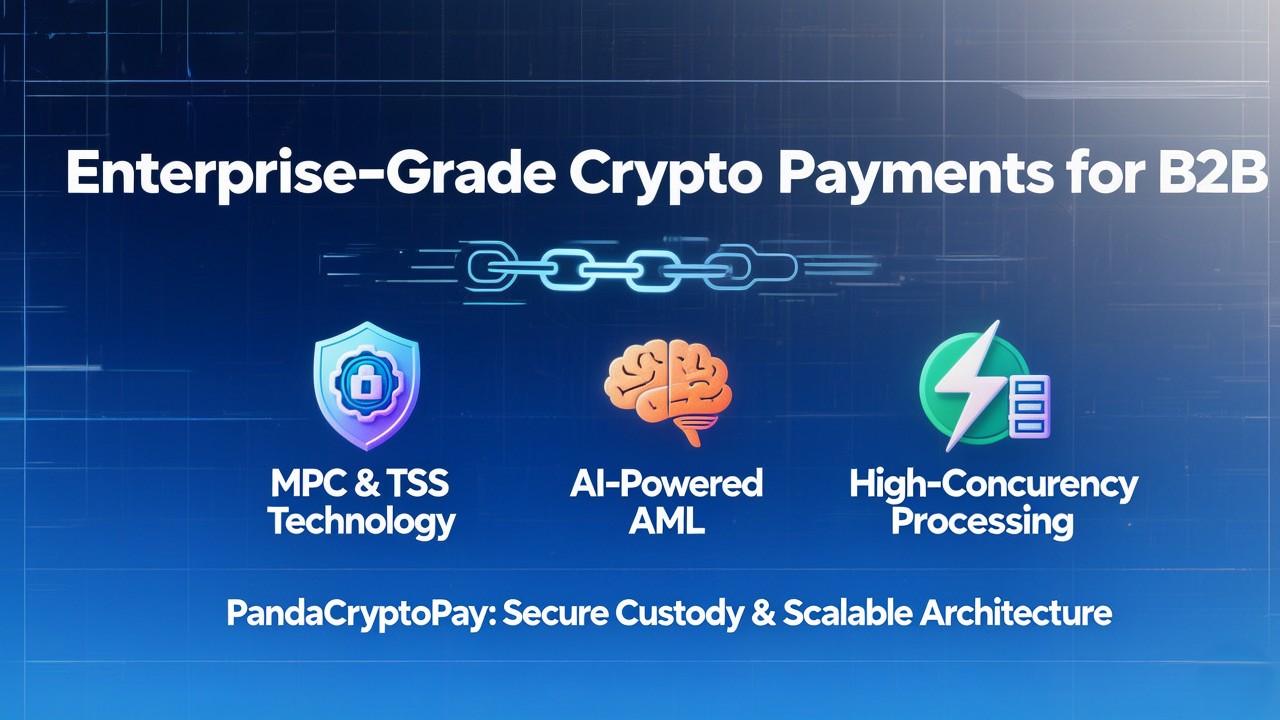

With the rapid growth of B2B stablecoin payments, enterprise-grade crypto payment solutions must meet increasingly higher requirements. PandaCryptoPay's "Secure Enterprise Custody and High-Concurrency Processing" architecture was developed specifically to address this need.

Enterprise-level crypto asset custody has entered a new technological phase. Compared to earlier single-private-key architectures, modern MPC (Secure Multi-Party Computation) technology stores private keys in fragments across multiple devices or servers. During signing, cryptographic protocols are used for collaborative computation, ensuring that the complete private key never appears in any single location.

PandaCryptoPay's MPC enterprise wallet solution employs advanced TSS (Threshold Signature Scheme) technology, supporting flexible private key fragmentation configurations and offering both "institutional wallets" and "end-user wallets" to meet the security control and access management needs of different business requirements.

Anti-money laundering risk control capabilities have become a core competitive advantage for enterprise crypto payment solutions. Faced with the anonymity of stablecoins and the challenges of on-chain and off-chain information fragmentation, leading B2B payment platforms are adopting a dual verification mechanism combining "on-chain behavior analysis and off-chain transaction authenticity verification."

PandaCryptoPay's solution integrates AI-driven anti-money laundering risk control infrastructure, automatically and accurately matching off-chain trade backgrounds with on-chain fund flows, supporting complex compliance requirements.

Future-oriented high-concurrency processing solutions need to consider the high-frequency demands of enterprise-level payments. As AI agents become active economic participants, unattended, high-frequency machine-to-machine payment scenarios are emerging.

PandaCryptoPay's dual-track payment architecture supports both traditional inter-enterprise transactions and automated payments initiated by AI agents, ensuring compliance for both payment types through a unified governance framework.

Technical Solution: Secure, Compliant B2B Crypto Payment Architecture

Cross-border trade payments are one of the most promising application scenarios for stablecoins. Deng Guobiao, founder and CEO of the B2B foreign trade finance platform XTransfer, stated, "More and more overseas companies are willing to try using stablecoins for cross-border trade payments." The company plans to launch a stablecoin cross-border trade payment service for overseas corporate users.

It is projected that within three years, stablecoin payments will account for more than one-third of XTransfer's total payments. Data from blockchain payment institution BVNK shows that they process approximately $15 billion in stablecoin payments annually, half of which comes from B2B trade payments.

Upstream supply chain management in the construction industry is another typical example. Construction projects typically involve multi-layered supply chains, from timber and cement to electrical and mechanical subsystems, and tax burdens vary significantly depending on region and project type.

B2B payment solutions for this scenario need to ensure that procurement is linked to specific projects, correctly applies local tax rates, and ensures that procurement activities comply with project budgets and authorization codes. For example, some platforms integrate tax rate calculation engines that can manage the complexities of different tax rates for the same material based on usage, buyer classification, and geographic location.

Corporate cash pooling and financial management are being optimized through stablecoins. For companies holding crypto assets or stablecoins as working capital for extended periods, some solutions are exploring revenue-generating opportunities for account balances, allowing clients to convert idle assets into revenue-generating assets while maintaining liquidity, thereby improving capital efficiency.

This capability is particularly suitable for large enterprises that typically manage numerous suppliers with diverse invoice formats, where traditional verification processes are time-consuming and labor-intensive.

Value Enhancement: B2B Crypto Payments as Strategic Assets

Enterprises' adoption of cryptocurrency payments has shifted from simple efficiency considerations to broader strategic value considerations. Payment execution is merely the surface-level action in B2B transactions; its success depends on the coordinated support of multiple links, such as data traceability, compliance processes, and the integrity of the approval chain.

When these workflows are optimized and integrated with stablecoin payment tracks, enterprises can achieve more efficient and reliable payment systems.

Integrating stablecoins into enterprise payment workflows expands the boundaries of value-added services. Enterprises can explore features such as instant financing, real-time invoice factoring, or embedded dynamic discounts.

All of this can be automated through workflow logic, with the stablecoin system serving as the underlying support for fund flows, achieving minimal friction operation.

Adopting crypto payment solutions helps enterprises build scalable global solutions. Relying on fragmented, ad-hoc cross-border payment methods makes it difficult for enterprises to scale.

Conversely, workflow platforms that integrate stablecoin payment tracks with dynamic compliance management can enter new markets at lower operating costs and faster speeds. This capability has immeasurable strategic value in today's globalized business environment.

Future Trends: Dual-Currency Wallets, AI & Regulation in B2B Crypto

Dual-currency wallets will become the new standard in B2B cross-border trade payments. More and more service providers will offer B2B cross-border trade companies dual-currency wallets (fiat currency + stablecoin), allowing companies to choose the payment method based on their trade characteristics, fund arrival timeliness, and fee costs.

This trend reflects both market and regulatory recognition: stablecoins will develop rapidly in the coming years, but they still cannot replace fiat currency. The demand for exchanging between the two will persist in the long term, which is a key reason why dual-currency wallets are becoming a trend.

The deep integration of AI and blockchain payments is ushering in a new payment paradigm. The payment industry is experiencing a dual turning point: on the one hand, stablecoin trading volume is constantly rising; on the other hand, AI agents are becoming active economic participants, driving demand for autonomous, high-frequency, and usage-based payment models.

In the future, solutions specifically built for AI agents and automated systems, such as the x402 smart payment gateway, will be able to handle micropayments, high-frequency transactions, and unattended machine-to-machine payments.

As technological maturity and real-world demand combine, Bitcoin's payment potential will be further unleashed. Enterprise-grade Lightning Network and other infrastructure will support higher-frequency, higher-value, and lower-latency fund transfers. This will fundamentally change the global fund settlement architecture, expanding Bitcoin's applications from a store of value to institutional-grade payment infrastructure.

.svg)

Payments designed to accelerate your business

Choose Nuvei for payments that work harder to convert sales and boost your bottom line.