Beyond Technology and Speed: Reshaping the Trust Foundation of the Digital Payment Ecosystem

With global digital payments set to exceed $15T by 2027, speed isn’t enough—trust deficits threaten sustainability. Real-time fraud, opaque chains & weak dispute resolution hurt SMEs & users. Blockchain, mCBDC nets & Trust-as-a-Service (TaaS) are rebuilding transparent, collaborative defenses. See how nations & firms are turning trust into a strategic asset.

In the digital payments field, technological iterations have pushed transaction speeds to the theoretical limit of milliseconds. However, the essence of financial activity has never changed: the ultimate foundation of all transactions is not transmission protocols or computing power, but a robust trust relationship between participants. As the global digital payments market is projected to surpass $15 trillion by 2027, our core challenge has shifted from improving efficiency to how to systematically build and maintain this intangible yet crucial trust asset.

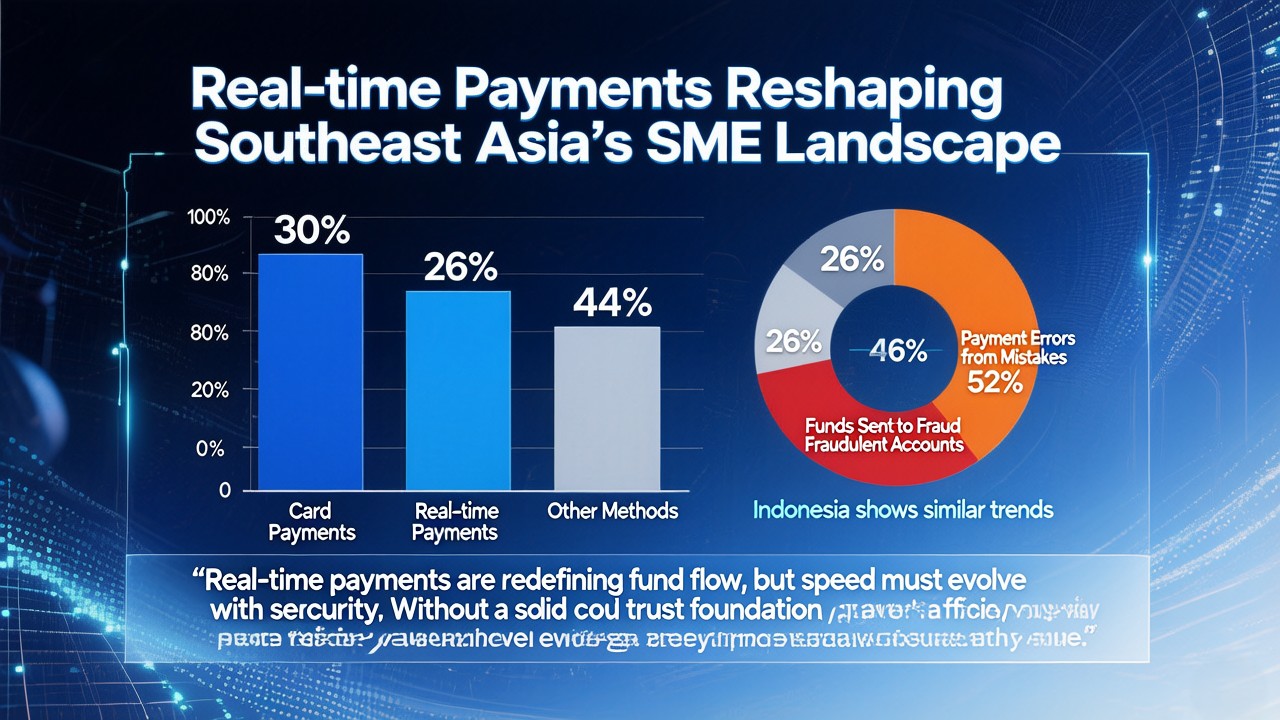

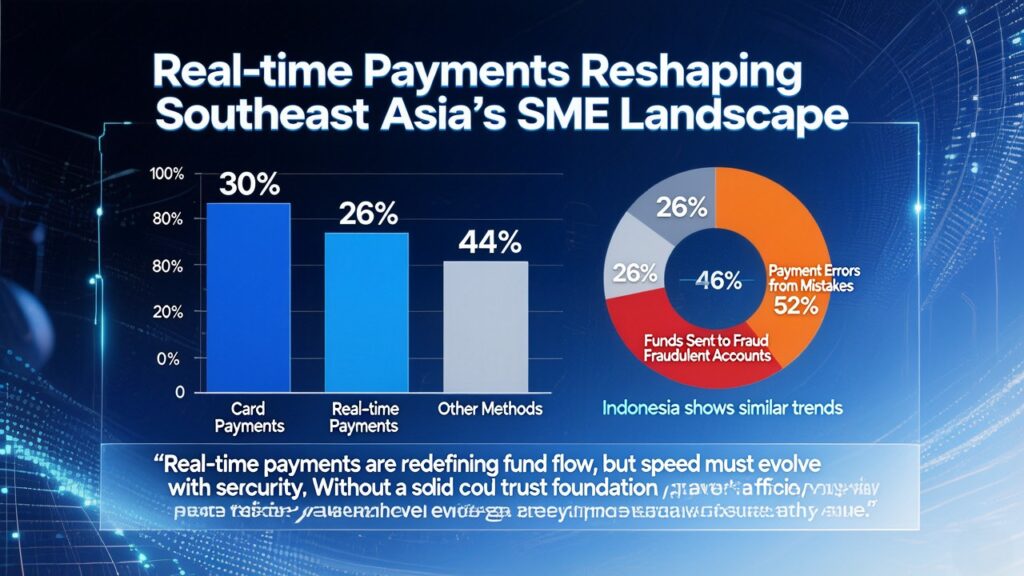

The dynamics of the Southeast Asian market are highly representative. According to a 2023 report jointly released by Visa and the Economist Intelligence Unit (EIU), real-time payments accounted for 26% of SME transactions in the region, becoming the second largest payment method after card payments (30%). However, the same report reveals deep-seated structural concerns: as many as 52% of Malaysian users are worried about payment errors caused by accidental actions, and 46% of users worry that funds will be transferred to fraudulent accounts. The Indonesian market exhibits a similar trend. Serene Gay, Country Manager for Visa Southeast Asia, clearly stated: “Real-time payments are reshaping the way funds flow, but speed must evolve in tandem with security. Payment efficiency lacking a solid foundation of trust will ultimately erode the sustainable value of the entire ecosystem.” Trust Deficit: Systemic Vulnerability in the Rapid Evolution of Digital Payments The evolution of payment technology exhibits a typical exponential pattern. Data from the Bank for International Settlements (BIS) shows that as of 2023, more than 70 jurisdictions worldwide had deployed real-time payment systems. However, the rapid expansion of technological infrastructure and the slow accumulation of social trust infrastructure have created an increasingly significant “trust deficit.” This deficit is not simply a technological flaw, but stems from a complex mismatch between user perception, business practices, and regulatory frameworks.

Detailed data reveals the breadth and depth of the trust crisis

Visa's research report, “Real-Time Payments in Southeast Asia: Unleashing Potential,” points out that payment errors and fraud risks have become users' primary concerns: in Singapore, 47% of consumers worry about transferring funds to the wrong account, and 37% fear fraudulent transactions; the corresponding proportions in Malaysia reach 52% and 46%, respectively. For SMEs, trust issues directly translate into operational risks: approximately 60% of Southeast Asian SMEs have faced cash flow disruptions due to payment errors or delays. The World Bank, in its 2023 Global Financial Inclusion Report, emphasized that after achieving initial financial access, enhancing users' sense of security and institutional trust is a key constraint in advancing financial services towards a "deep financial inclusion" stage.

From a broader perspective, the current digital payment ecosystem is undergoing a paradigm shift from a closed "channel" to an open "ecosystem." The healthy operation of an ecosystem depends on collaboration and trust among diverse participants. However, the current state of ambiguous responsibilities, insufficient information transparency, and inefficient dispute resolution mechanisms makes it difficult for systemic trust to form spontaneously.

Trust Meets Blockchain: Transparency Redefines Payment Accountability

One of the core root causes of the vulnerability of trust in digital payments lies in information asymmetry. The multi-stage and opaque nature of the payment chain makes the flow of funds a "black box" for end users. Once a dispute arises, tracing, assigning responsibility, and seeking redress all face high costs. Blockchain technology, with its distributed, immutable, and traceable characteristics, provides a new technological paradigm for building auditable and transparent accountability mechanisms. Its core value lies not in replacing fiat currency, but in serving as an underlying trust layer, providing verifiable transaction facts.

Global central banks and the private sector are exploring this frontier. The Reserve Bank of India's (RBI) 2023 proposal is strategically significant: utilizing consortium blockchain technology to build a cross-border payment and settlement network among the BRICS countries. The essence of this design is not issuing entirely new digital currencies, but rather constructing a distributed ledger jointly maintained by member central banks, enabling real-time, multilateral, and synchronized verification of transaction status. This approach, while respecting national monetary sovereignty and regulatory jurisdiction, is expected to significantly improve the transparency of cross-border payments, reduce reliance on correspondent banks, and compress settlement cycles from days to hours. A 2024 research report by the International Monetary Fund (IMF) pointed out that such multilateral central bank digital currency (mCBDC) arrangements specifically address the long-standing pain points of high costs, slow speeds, and insufficient transparency in traditional cross-border payments.

The application of transparent trust mechanisms in the real economy has also yielded empirical results. The "Tea Credit Code" system deployed by Lichuan City, Hubei Province, for 843 tea enterprises within its jurisdiction is a typical example of visualized credit operations. This system aggregates credit data from multiple sources, including market supervision, taxation, and banking, generating dynamically updated, enterprise-specific credit QR codes. Consumers can scan the code to obtain basic enterprise information, credit ratings (A/B/C/D), administrative penalty history, and product quality inspection results. This practice has driven a shift in consumer decision-making from experience-based reliance to credit verification. Reports indicate that after the system's implementation, the pass rate for local tea product inspections systematically increased from 92% to 98.6%, and related consumer complaints decreased by 40%. This demonstrates that transforming backend credit data into easily verifiable frontend trust indicators can effectively reduce information friction and promote a virtuous cycle of market efficiency and integrity.

Risk Control Paradigm Shift: From Static Rules to Dynamic Collaborative Intelligent Defense

Real-time payment, while improving capital efficiency, also objectively lowers the threshold for fraudulent activities. Data from the Australian Securities and Investments Commission (ASIC) shows that in 2023, losses from investment fraud alone reached A$1.3 billion in Australia, with the vast majority of funds rapidly transferred through real-time payment channels. Traditional risk control systems, relying on static rule lists and post-incident investigations, have shown shortcomings in response to highly professional, organized, and rapidly evolving financial crime methods, exhibiting both lag and insufficient coverage.

A cutting-edge solution is to build a dynamic, intelligent risk prevention and control system with network synergy. For example, BioCatch Trust™, the world's first interbank real-time financial crime intelligence network launched by BioCatch, connects participating financial institutions through secure protocols, enabling the anonymized sharing of biometric data, device fingerprints, network intelligence, and transaction patterns related to fraud, forming an industry-level collective defense capability. Its paradigm innovation lies in the real-time assessment and early warning of "recipient risk." For instance, when a customer of Bank A initiates a transfer to an account already flagged as high-risk by other institutions within the network, Bank A can receive a risk alert milliseconds before the transaction is executed, thus enabling it to intervene. This changes the limitations of traditional risk control, which overemphasizes the risk of the transaction initiator while neglecting the risk of the fund recipient.

This collaborative defense model has already produced measurable positive impacts. In Australia, major banks, including the Commonwealth Bank (CBA), have joined the network to jointly provide enhanced protection for over 18 million customer accounts. Initial operational data shows that participating institutions have seen a significant improvement in their ability to identify authorized push payment (APP) fraud. In May 2025, major banks and fintech companies in Argentina jointly launched a similar real-time fraud intelligence sharing program, marking the global recognition and promotion of this industry-collaborative "cyber immunity" model. European Central Bank (ECB) policymakers have also publicly emphasized that such cross-institutional collaboration has "critical defensive value" in the face of the borderless threat of payment fraud.

Building an institutionalized collaborative oversight network: Beyond institutional silos

Traditional financial security models are often limited to "defense silos" within institutions, while modern financial crimes are characterized by their cross-institutional, cross-jurisdictional, and high-tech nature, making the protection systems of a single institution extremely vulnerable to penetration. Therefore, establishing institutionalized, standardized, and regulatory-compliant cross-agency collaborative networks has become an inevitable path for industry development.

Visa, in its research report, strongly advocates building robust public-private partnerships (PPPs) to integrate the resources and capabilities of government departments, regulatory agencies, payment networks, technology providers, and enterprises. The value of such symbiotic oversight networks follows the law of network effects: an increase in the number of participating nodes exponentially enhances the diversity, real-time nature, and accuracy of risk data across the network, thereby strengthening the overall ecosystem's resilience.

It is worth noting that next-generation collaborative networks deeply integrate Regulatory Technology (RegTech) principles from the architectural design stage. For example, they commonly employ hash algorithms to process account identifiers, implement data anonymization, utilize end-to-end encryption, and deploy strict Role-Based Access Control (RBAC). These technical safeguards ensure that cross-agency data collaboration is conducted within the framework of the EU General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and other regional data protection regulations. The Monetary Authority of Singapore's (MAS) "Collaborative Analytics" platform is an example of regulators promoting compliant data sharing, allowing financial institutions to jointly conduct fraud pattern analysis and insights while meeting stringent privacy protection requirements.

Trust as a Service (TaaS): Turning Trust into a Core Value Proposition

When trust can be standardized, verified, and delivered through institutional design, technological empowerment, and third-party credit enhancement mechanisms, a new business model emerges—"Trust as a Service" (TaaS). This signifies that trust has transformed from a back-end operational cost center into a measurable and tradable front-end core value proposition.

The "Chuxin'an" full-scenario prepaid consumption notarization service platform launched in Hubei Province, China, is a typical example of TaaS in the consumer finance sector. This platform introduces a notary public as an independent fund custodian. Consumers' prepaid funds go directly into a dedicated escrow account at the notary public office, and the funds are only transferred to the merchant after the consumer confirms the completion of the consumption. This mechanism completely restructures the trust relationship in prepaid consumption scenarios, providing explicit credit endorsement for trustworthy merchants, thereby improving their customer conversion rate and brand value; at the same time, it gives consumers certainty about the safety of their funds. Operational data shows that the average customer complaint rate of merchants connected to the platform has decreased by more than 60%, and customer repurchase rates have significantly increased.

In the public service sector, the "trust-based" property management model explored by Gulou Street in Ezhou City, Hubei Province, can be seen as an extension of the TaaS (Tax as a Service) logic into social governance. This model is based on a trust legal relationship, with all homeowners acting as settlors and the property management company as the trustee. All property fees and public revenues are deposited into a transparent, jointly managed account, with every transaction disclosed to homeowners in real time. Under this framework, the property management company's role shifts from "management entity" to "service trustee," and its interests are directly linked to the preservation and appreciation of homeowners' shared assets. The implementation has yielded significant results: in the pilot community of Guanliu, the property fee payment rate increased dramatically from 40% to 67%, and the number of recorded neighborhood disputes decreased from 201 to 31. Related research from Harvard University points out that institutional transparency is one of the most effective mechanisms for cultivating and consolidating public trust, and this case provides localized empirical evidence for this assertion.

We are living in an era where the economic value of trust is unprecedentedly prominent. A Visa report indicates that 38% of SMEs in Southeast Asia still cite fraud and scams as their primary payment pain point. In contrast, tea companies in Lichuan, Hubei Province, have transformed credit into a competitive market advantage through the "Tea Credit Code" system, gaining higher product premiums and customer loyalty. This gap essentially reflects the varying degrees of sophistication in the "trust infrastructure" across different economic ecosystems.

The future leaders of the digital payment ecosystem will not necessarily be those with the most advanced technology or the most competitive rates, but rather those institutions capable of systematically building, efficiently transmitting, and reliably realizing the value of trust. When payment systems transcend their original function as conduits for funds and evolve into trust networks capable of supporting complex socio-economic relationships and ensuring the secure transfer of value, digital finance will truly solidify its foundation for serving the real economy.

Ultimately, the measure of a financial system's maturity and robustness is not its peak transaction processing speed, but its ability to acquire and maintain social trust over the long term.

.svg)

Payments designed to accelerate your business

Choose Nuvei for payments that work harder to convert sales and boost your bottom line.