The Evolution of Digital Payments: A Technological Triangle Reshaping the Financial Trust System

AI, blockchain & biometrics reshape digital payments. Cut fraud, boost trust, automate trade finance. See how tech convergence builds secure, sustainable payment ecosystems.

The payment process in the contemporary financial system has evolved from simple monetary exchange into a complex technological convergence. Artificial intelligence, blockchain, and biometrics are synergistically driving profound changes in payment infrastructure. At the heart of this transformation lies the fact that the integration of transaction convenience and system credibility is creating new dimensions of value; the payment process itself is becoming a comprehensive platform for digital identity management and value transfer.

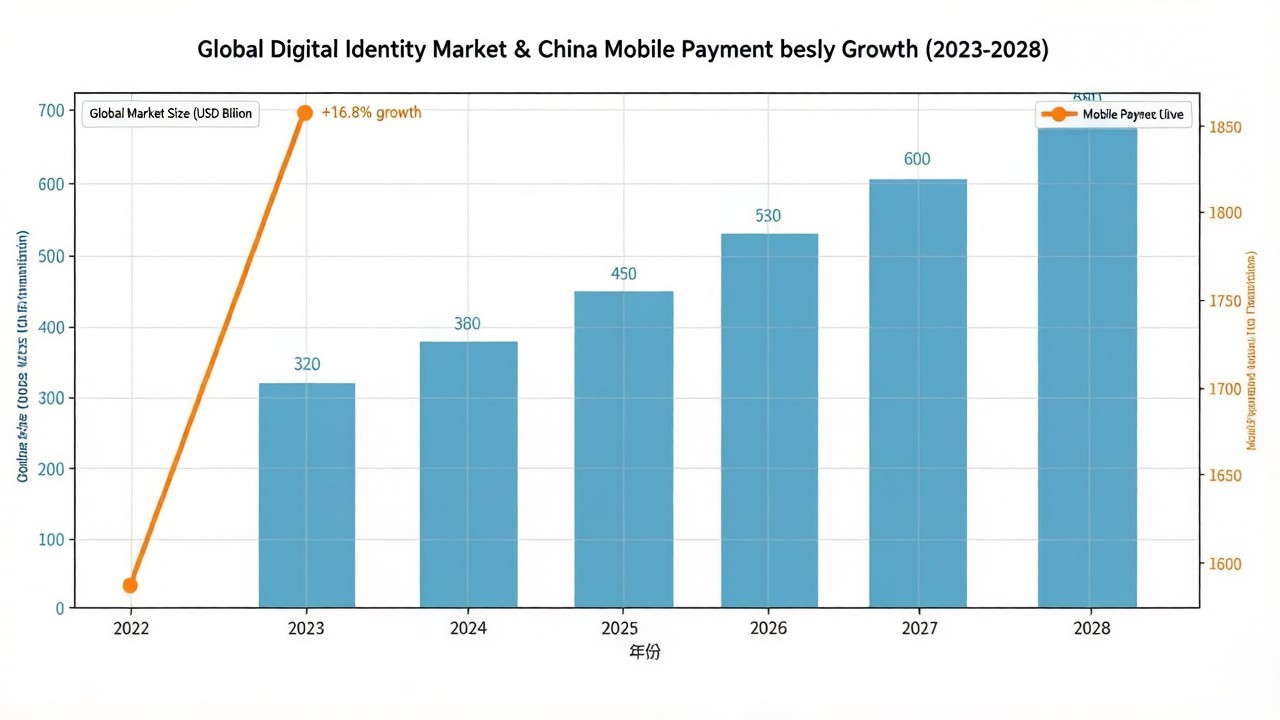

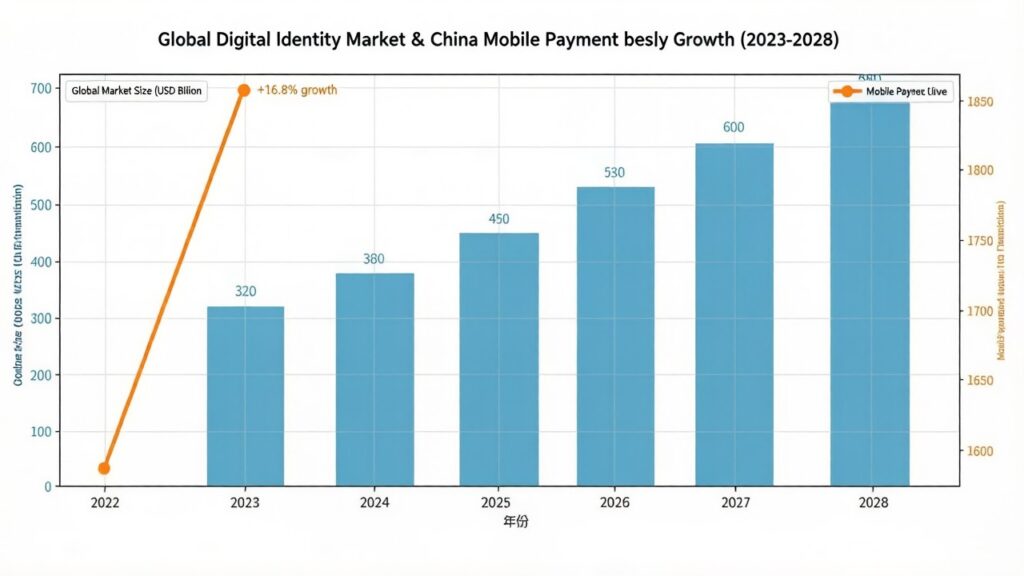

Data from the global identity verification market confirms this trend. According to Juniper Research's report, "Digital Identity Verification: Key Trends and Market Forecasts 2023-2028," the global digital identity verification market is projected to reach $68 billion by 2028, more than doubling from $32 billion in 2023. The development in the Chinese market is equally significant—the People's Bank of China's "Overall Operation of the Payment System in 2023" shows that China's mobile payment transactions reached 185.147 billion, amounting to 526.98 trillion yuan, representing year-on-year increases of 16.8% and 11.1%, respectively. Behind these figures lies the urgent need of financial institutions for enhanced security solutions and compliance frameworks.

Intelligent Risk Control: From Passive Response to Proactive Protection

Traditional risk control models often lag behind fraudulent activities, but artificial intelligence is changing this. Through deep learning algorithms, the system can build user behavior profiles and achieve millisecond-level risk assessment. Visa, in its 2023 cybersecurity report, disclosed that its AI risk control system prevents approximately $25 billion in fraudulent transactions annually, with a 30% lower false positive rate compared to traditional systems.

The real breakthrough comes from technological synergy. When the AI system detects abnormal transaction patterns, it can retrieve immutable transaction history from the blockchain in real time for verification, simultaneously initiating a multimodal biometric process. This comprehensive defense mechanism has proven highly effective in practical applications: China Merchants Bank's "Libra" risk control system, by combining AI behavioral analysis with iris recognition technology, has increased the accuracy of high-risk transaction interception to 99.7%, while reducing verification time to 0.8 seconds.

Identity Management: From Centralized Storage to Autonomous Control

Frequent data breaches have exposed the vulnerability of centralized storage. According to IBM's "2023 Cost of Data Breach Report," the average cost of a data breach globally reached a record high of $4.45 million. Decentralized identity architecture addresses this fundamental problem through technological means.

Practical application cases demonstrate the feasibility of this technology. Accenture's digital identity platform, developed in collaboration with Microsoft, achieves cross-institutional identity recognition based on blockchain technology. In pilot projects, encrypted identity credentials generated by users' fingerprints and facial features can be securely used in various scenarios such as healthcare and finance, with the original biometric data always under the user's control. Ant Group's "Morse" privacy computing platform processed over 210 million identity verification requests during the 2023 Double Eleven shopping festival using multi-party secure computation technology, achieving zero data breaches.

Process Reengineering: From Manual Operation to Intelligent Execution

Cross-border trade scenarios fully demonstrate the transformative potential of smart contracts. In 2023, China Construction Bank and Standard Chartered Bank completed a blockchain trade finance platform, automating the entire process from letter of credit issuance and goods tracking to fund settlement. The platform's first cross-border transaction reduced a traditional 5-7 business day process to within 4 hours, while simultaneously lowering operational costs by approximately 40%.

The Monetary Authority of Singapore's Project Ubin provides another example. This payment network trial, based on distributed ledger technology, enabled real-time settlement of cross-currency payments, achieving a peak daily processing volume of S$100 billion. The project's final report showed that the system could reduce cross-border payment costs by 30%-50%, while shortening settlement time from 2-3 days to just a few minutes.

Ecosystem Expansion: From Transaction Tool to Value Carrier

The development of sustainable finance has given payment technology a new mission. Mastercard's carbon calculation platform, launched in 2023 in partnership with Swedish fintech company Doconomy, can calculate the carbon emissions of each transaction in real time. The platform has connected with over 5,000 banks globally and has cumulatively tracked the carbon footprint of over 120 million transactions.

The European Central Bank's digital euro design also incorporates sustainable principles. According to its 2023 progress report, the digital euro architecture specifically considers energy efficiency, optimizing the consensus mechanism to keep energy consumption below 1% of traditional systems. This design philosophy demonstrates that the environmental impact of payment systems is becoming a key consideration in technology decisions.

Conclusion

Technological convergence is redefining the boundaries and meaning of payments. From risk management to identity management, from process optimization to value extension, the synergy of artificial intelligence, blockchain, and biometrics is building a more secure, efficient, and responsible payment ecosystem.

Industry practice shows that the key to success lies in balancing the speed of innovation with system robustness. The Bank for International Settlements' 2023 Annual Report indicates that approximately 90% of central banks globally are actively exploring central bank digital currencies, with more than half already in the pilot phase. This widespread exploration reflects the financial system's positive response to technological change.

The future direction of payment systems is clear: achieving greater inclusiveness and sustainability while ensuring security and reliability. Technological evolution is not only a tool for efficiency improvement but also the foundation for building a more equitable and transparent financial ecosystem. For practitioners, understanding the inherent logic of technological convergence and striking a balance between innovation and standardization will be key to maintaining competitiveness in this transformation.

.svg)

Payments designed to accelerate your business

Choose Nuvei for payments that work harder to convert sales and boost your bottom line.